Insurance Fraud Detection Using Novel Machine Learning Technique

Keywords:

Insurance Fraud, Block chain technique, RF classifier, SVM classifier, Hybrid ERFSVM classifierAbstract

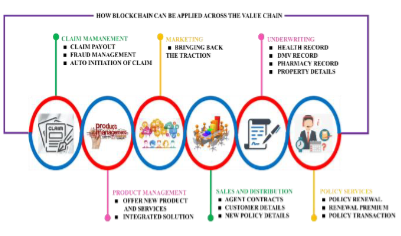

The ultimate focus of the insurance agency is the management of financial risks, since it includes a sizable amount of daily transactions. It is mandatory for the insurance industry to develop the capability of identifying the fraudulent activities with increased accuracy in order to minimize the excessive unwarranted loss due to claim leakage. Initially, many fraud detecting techniques has been introduced and it relies on the heuristics around fraud indicators, also on the checklist prepared about frauds. However, the above mentioned traditional techniques highly relies on the manual intervention. Therefore, for eliminating the above mentioned issues, the insurance companies are looking towards machine learning based fraud detection techniques. In this paper, initially a block chain technique is presented as a secure network by the insurance agencies to detect, store and share different customer informations. Then, a hybrid classifier called eRFSVM, which entails Random Forest (RF) and Support Vector Machine (SVM) algorithm is used for classifying the insurance frauds. Additionally, to analyse the working of the proposed work, it is implemented in Python software.

Downloads

References

Austin, Insurance Fraud Handbook, Association of Certified Fraud Examiners, TX, USA, Oct. 2018.

N. Dhieb, H. Ghazzai, H. Besbes and Y. Massoud, "A Secure AI-Driven Architecture for Automated Insurance Systems: Fraud Detection and Risk Measurement," in IEEE Access, Vol. 8, pp. 58546-58558, 2020.

I. Matloob, S. A. Khan and H. U. Rahman, "Sequence Mining and Prediction-Based Healthcare Fraud Detection Methodology," in IEEE Access, Vol. 8, pp. 143256-143273, 2020.

Chauhan, T., and S. Sonawane. “The Contemplation of Explainable Artificial Intelligence Techniques: Model Interpretation Using Explainable AI”. International Journal on Recent and Innovation Trends in Computing and Communication, vol. 10, no. 4, Apr. 2022, pp. 65-71, doi:10.17762/ijritcc.v10i4.5538.

C. Sun, Q. Li, H. Li, Y. Shi, S. Zhang and W. Guo, "Patient Cluster Divergence Based Healthcare Insurance Fraudster Detection," in IEEE Access, Vol. 7, pp. 14162-14170, 2019.

C. Sun, Z. Yan, Q. Li, Y. Zheng, X. Lu and L. Cui, "Abnormal Group-Based Joint Medical Fraud Detection," in IEEE Access, Vol. 7, pp. 13589-13596, 2019.

K. Nian, H. Zhang, A. Tayal, T. Coleman, Y. Li, "Auto insurance fraud detection using unsupervised spectral ranking for anomaly." The Journal of Finance and Data Science 2, no. 1: 58-75, 2016.

Agarwal, D. A. . (2022). Advancing Privacy and Security of Internet of Things to Find Integrated Solutions. International Journal on Future Revolution in Computer Science &Amp; Communication Engineering, 8(2), 05–08. https://doi.org/10.17762/ijfrcsce.v8i2.2067

S. Subudhi, S. Panigrahi, "Use of optimized Fuzzy C-Means clustering and supervised classifiers for automobile insurance fraud detection." Journal of King Saud University-Computer and Information Sciences 32, no. 5: 568-575, 2020.

S. K. Majhi, S. Bhatachharya, R. Pradhan, S. Biswal, "Fuzzy clustering using salp swarm algorithm for automobile insurance fraud detection." Journal of Intelligent & Fuzzy Systems 36, no. 3: 2333-2344, 2019.

I. Fursov et al., "Sequence Embeddings Help Detect Insurance Fraud," in IEEE Access, Vol. 10, pp. 32060-32074, 2022.

A. Shetty, A.D. Shetty, R. Y. Pai, R. R. Rao, R. Bhandary, J. Shetty, S. Nayak, T. Keerthi Dinesh, K. J. Dsouza, "Block Chain Application in Insurance Services: A Systematic Review of the Evidence." SAGE Open 12, no. 1, 2022.

S Nakamoto, "Bitcoin: A peer-to-peer electronic cash system." Decentralized Business Review, 2008.

A. A. Amponsah, F. A. Adebayo, B. A. WEYORI, "Blockchain in Insurance: Exploratory Analysis of Prospects and Threats." International Journal of Advanced Computer Science and Applications 12, no. 1 2021.

F. Casino, T. K. Dasaklis, C. Patsakis, "A systematic literature review of blockchain-based applications: Current status, classification and open issues." Telematics and informatics 36: 55-81, 2019.

Joy, P., Thanka, R., & Edwin, B. (2022). Smart Self-Pollination for Future Agricultural-A Computational Structure for Micro Air Vehicles with Man-Made and Artificial Intelligence. International Journal of Intelligent Systems and Applications in Engineering, 10(2), 170–174. Retrieved from https://ijisae.org/index.php/IJISAE/article/view/1743

E. Kapsammer, B. Pröll, W. Retschitzegger, W. Schwinger, M. Weißenbek, J. Schönböck, "The Blockchain Muddle: A Bird's-Eye View on Blockchain Surveys." In Proceedings of the 20th International Conference on Information Integration and Web-based Applications & Services, pp. 370-374, 2018.

Y. Dong, K. Xie, Z. Bohan and L. Lin, "A Machine Learning Model for Product Fraud Detection Based On SVM," 2021 2nd International Conference on Education, Knowledge and Information Management (ICEKIM), pp. 385-388, 2021.

André Sanches Fonseca Sobrinho. (2020). An Embedded Systems Remote Course. Journal of Online Engineering Education, 11(2), 01–07. Retrieved from http://onlineengineeringeducation.com/index.php/joee/article/view/39

P. Naveen and B. Diwan, "Relative Analysis of ML Algorithm QDA, LR and SVM for Credit Card Fraud Detection Dataset," 2020 Fourth International Conference on I-SMAC (IoT in Social, Mobile, Analytics and Cloud) (I-SMAC), pp. 976-981, 2020.

P. Singh, V. Chauhan, S. Singh, P. Agarwal and S. Agrawal, "Model for Credit Card Fraud Detection using Machine Learning Algorithm," 2021 International Conference on Technological Advancements and Innovations (ICTAI), pp. 15-19, 2021.

M. S. Kumar, V. Soundarya, S. Kavitha, E. S. Keerthika and E. Aswini, "Credit Card Fraud Detection Using Random Forest Algorithm," 2019 3rd International Conference on Computing and Communications Technologies (ICCCT), 2019.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All papers should be submitted electronically. All submitted manuscripts must be original work that is not under submission at another journal or under consideration for publication in another form, such as a monograph or chapter of a book. Authors of submitted papers are obligated not to submit their paper for publication elsewhere until an editorial decision is rendered on their submission. Further, authors of accepted papers are prohibited from publishing the results in other publications that appear before the paper is published in the Journal unless they receive approval for doing so from the Editor-In-Chief.

IJISAE open access articles are licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. This license lets the audience to give appropriate credit, provide a link to the license, and indicate if changes were made and if they remix, transform, or build upon the material, they must distribute contributions under the same license as the original.