A Technical Analysis Based Prediction of Stock Market Trading Strategies Using Deep Learning and Machine Learning Algorithms

Keywords:

Stock Market; Technical Analysis; Machine Learning; Deep Learning; PredictionAbstract

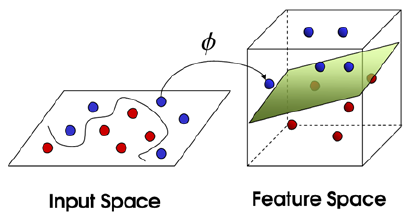

Stock market movement follows the random walk nature. The technical analysis incorporates the use of various technical indicators. Technical analysis is well suited for short term predictions. In this research work, Machine learning algorithms - Decision Tree, Support Vector Machine, Naïve Bayes and Deep Learning algorithms- Convolutional Neural Networks and Generative Adversarial Networks are used for the stock market prediction problem. Datasets of three companies- Maruti Suzuki, HDFC and Infosys belonging to Automobile, Banking and IT sector listed on National Stock Exchange (NSE) - Indian stock market over the period of 6 years (June 2014-June 2020) are considered. Performance of the above algorithms is measured in terms of how accurately they predict the stock movements. For the construction of learning models cross validation as well as training-testing percentage split are used. From the results, it is clear that deep learning algorithms show better prediction accuracy as compared to machine learning models.

Downloads

References

Patel, J., Shah, S., Thakkar, P., & Kotecha, K. (2014 a). Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert Systems with Applications. Volume 42, Issue 1, January 2015, Pages 259-268. https://doi.org/10.1016/j.eswa.2014.07.040

Patel, J., Shah, S., Thakkar, P., & Kotecha, K. (2015 b). Predicting stock market index using fusion of machine learning techniques. Expert Systems with Applications. Volume 42, Issue 4, Pages 2162-2172. https://doi.org/10.1016/j.eswa.2014.10.031

Aldin, M., M., Dehnavi, H., D., & Entezari, S. (2012) Evaluating the employment of technical indicators in predicting stock price index variations using artificial neural networks (case study: Tehran stock exchange). International Journal of Business & Management, Vol. 7, No. 15. 10.5539/ijbm.v7n15p25

Sakhare, N., & Shaik I. (2019). Performance Analysis of Regression-Based Machine Learning Techniques for Prediction of Stock Market Movement. International Journal of Recent Technology and Engineering (IJRTE) ISSN: 2277-3878, Volume-7, Issue-6S4, April 2019.

Wu, M., and Diao, X. (2015). Technical Analysis of Three Stock Oscillators- Testing MACD, RSI and KDJ Rules in SH and SZ stock markets. INSPEC Accession Number: 16090318, 2015 4th International Conference on Computer Science and Network Technology (ICCSNT), 10.1109/ICCSNT.2015.7490760

Zhang, J., Cui, S., Xu, Y., Li, Q., & Li, T, (2018). A novel data-driven stock price trend prediction system. Expert Systems with Applications. Volume 97, 1 May 2018, Pages 60-69. https://doi.org/10.1016/j.eswa.2017.12.026

Romero R., Torres A., & Etcheverry, G.(2016). Forecasting of Stock Return Prices with Sparse Representation of Financial Time Series Over Redundant Dictionaries. Expert Systems with Applications. Volume 57, 15 September 2016, Pages 37-48. https://doi.org/10.1016/j.eswa.2016.03.021

Shynkevich, Y., McGinnity, T.M., Coleman, S.A., Belatreche, A., Li, Y., (2017). Forecasting price movements using technical indicators: Investing the impact of varying input window length. Neurocomputing Volume 264, 15 November 2017, Pages 71-88. https://doi.org/10.1016/j.neucom.2016.11.095

Najafi, A., Pourahmadi,Z. (2016) An efficient heuristic method for dynamic portfolio selection problem under transaction costs and uncertain conditions, Physica A: Statistical Mechanics and its Applications, Volume 448, 2016, Pages 154-162, ISSN 0378-4371, https://doi.org/10.1016/j.physa.2015.12.048.

Dhar, V., (2011) Prediction in financial markets: The case for small disjuncts. ACM Transactions on Intelligent Systems and Technology. May 2011 Article No.: 19 https://doi.org/10.1145/1961189.1961191

Tripathi V, Seth R. Stock Market Performance and Macroeconomic Factors: The Study of Indian Equity Market. Global Business Review. 2014;15(2):291-316. doi:10.1177/0972150914523599

Kantavat, P., & Kijsirikul, B., (2008). Combining Technical Analysis and Support Vector Machine for Stock Trading. 2008 Eighth International Conference on Hybrid Intelligent Systems. INSPEC Accession Number: 10234656 DOI: 10.1109/HIS.2008.76

Wang, L.,X., (2015 a). Dynamic Models of Stock Prices Based On Technical Trading Rules Part-I: The Models., INSPEC Accession Number: 15328525, IEEE Transactions on Fuzzy Systems, Volume: 23, Issue: 4, pp. 787 – 801. DOI: 10.1109/TFUZZ.2014.2327994

Wang, L., X., (2015 b). Dynamic Models of Stock Prices Based On Technical Trading Rules Part-II: The Models, INSPEC Accession Number: 15328516, IEEE Transactions on Fuzzy Systems, Volume: 23, Issue: 4, pp. 1127 – 1141.

Lean, Y., Huanhuan, C., Wang, S., & Lai, K., (2009). Evolving Least Squares Support Vector Machines for Stock Market Trend Mining. IEEE Transaction on Evolutionary Computation, vol. 13, issue 1, pp.87-102. INSPEC Accession Number: 10417124 DOI: 10.1109/TEVC.2008.928176

Tayali,H.A.,& Tolun, S. (2018). Dimension reduction in mean-variance portfolio optimization. Expert Systems with Applications

Volume 92, February 2018, Pages 161-169. https://doi.org/10.1016/j.eswa.2017.09.009

Sharma, A., Bhuniya, D., & Singh, U. (2017). Survey of Stock Market Prediction Using Machine Learning Approach. IEEE, International Conference of Electronics, Communication and Aerospace Technology, INSPEC Accession Number: 17433061 DOI: 10.1109/ICECA.2017.8212715

Rubio, A., Bermudez, J., & Vercher, E. (2016). Forecasting portfolio returns using weighted fuzzy time series methods. International Journal of Approximate Reasoning. Volume 75, August 2016, Pages 1-12. https://doi.org/10.1016/j.ijar.2016.03.007

Nuij, W., Milea, V., Hogenboom, F., Frasincar, F., & Kaymak, U. (2014). An Automated Framework for Incorporating News into Stock Trading Strategies," IEEE Transactions on Knowledge and Data Engineering, Volume: 26, Issue: 4, April 2014, pp: 823 – 835 INSPEC Accession Number: 14181444, DOI: 10.1109/TKDE.2013.133

Huang, W., Nakamori, Y., & Wang, S. (2005) Forecasting stock market movement direction with support vector machine Computers& Operations Research. Vol. 32 pp. 2513 – 2522. DOI:10.1016/j.cor.2004.03.016

Cervello-Royo, R., Guijarro, F., & Michniuk, K., (2015) Stock market trading rule based on pattern recognition and technical analysis: Forecasting the DJIA index with intraday data. Expert Systems with Applications Volume 42, Issue 14, 15 August 2015, Pages 5963-5975 https://doi.org/10.1016/j.eswa.2015.03.017

Tsinaslandis, P., E., (2018). Subsequence dynamic time wrapping for charting: Bullish and bearish class predictions for NYSE stocks. Expert Systems with Applications. Volume 94, 15 March 2018, Pages 193-204. https://doi.org/10.1016/j.eswa.2017.10.055

Chen, Y., (2014) Enhancement of Stock Market Forecasting Using a Technical Analysis Based Approach. 2014 IEEE 5th International Conference on Software Engineering and Service Science, INSPEC Accession Number: 14698833 DOI: 10.1109/ICSESS.2014.6933664

Qiu, M., Song, Y., & Akagi, F. (2016). Application of artificial neural network for the prediction of stock market returns: The case of Japanese Stock Market. Chaos, Solitons & Fractals. Volume 85, April 2016, Pages 1-7. https://doi.org/10.1016/j.chaos.2016.01.004

Dash, R., & Dash, P. (2016). A hybrid stock trading framework integrating technical analysis with machine learning techniques. The Journal of Finance and Data Science. Volume 2, Issue 1, March 2016, Pages 42-57. https://doi.org/10.1016/j.jfds.2016.03.002

Joshi, S., & Sakhare, N. (2015). History Bits based novel algorithm for classification of structured data. IEEE International Advance Computing Conference (IACC), Banglore, pp. 609-612. DOI: 10.1109/IADCC.2015.7154779.

Zhang, K., Zhong, G., Dong, J., Wang, S., & Wang, Y. (2019). Stock Market Prediction Based on Generative Adversarial Network. Procedia Computer Science Volume 147, Pages 400-406. https://doi.org/10.1016/j.procs.2019.01.256

Hiransha M, Gopalakrishnan E.A., Menon, V., K., Soman K.P., (2018) NSE Stock Market Prediction Using Deep-Learning Models, Procedia Computer Science, Volume 132, Pages 1351-1362, ISSN 1877-0509, https://doi.org/10.1016/j.procs.2018.05.050.

Sakhare, N. & Joshi, S. (2014). Classification of Criminal Data Using J48 Algorithm, International Journal of Data warehousing and Mining. Vol. 4.pp. 167-171.

Prasetijo, A., Saputro, T., Windasari, I., & Windarto, Y., (2017) Buy/sell signal detection in stock trading with Bollinger bands and parabolic SAR: With web application for proofing trading strategy 2017 4th International Conference on Information Technology, Computer, and Electrical Engineering (ICITACEE). INSPEC Accession Number: 17503416 DOI: 10.1109/ICITACEE.2017.8257672

Sakhare, N., Shaik, S., Kagad, S., Kapadwanjwala, T., Malekar, H., & Dalal, M. (2020) Stock Market Prediction Using Sentiment Analysis. International Journal of Advanced Science and Technology. 29, 4s 1126 - 1133.

Aitken, M., Cumming, D., & Zhan, F., (2015). High frequency trading and end-of-day price dislocation, Journal of Banking & Finance,

Volume 59, Pages 330-349, ISSN 0378-4266, https://doi.org/10.1016/j.jbankfin.2015.06.011.

https://www.investopedia.com/terms/t/technical-analysis-of-stocks-and-trends.asp

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Nitin Nandkumar Sakhare, Dr. S. Sagar Imambi

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All papers should be submitted electronically. All submitted manuscripts must be original work that is not under submission at another journal or under consideration for publication in another form, such as a monograph or chapter of a book. Authors of submitted papers are obligated not to submit their paper for publication elsewhere until an editorial decision is rendered on their submission. Further, authors of accepted papers are prohibited from publishing the results in other publications that appear before the paper is published in the Journal unless they receive approval for doing so from the Editor-In-Chief.

IJISAE open access articles are licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. This license lets the audience to give appropriate credit, provide a link to the license, and indicate if changes were made and if they remix, transform, or build upon the material, they must distribute contributions under the same license as the original.