Estimation of Residential Land Price in the Suburban Region of India, A Comparison between Artificial Neural Network and Hedonic Price Model

Keywords:

Artificial neural network, Hedonic pricing model, Prediction performance evaluation, Sub urban residential land priceAbstract

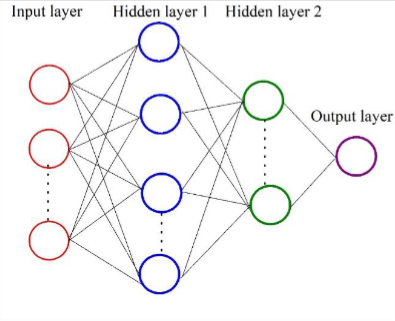

The real estate land price valuation is a global issue, and its importance is not limited to the real estate market but also in the banking sector, insurance sector, and governing bodies for taxation and acquisitions. This paper compares the accuracy of the Hedonic Pricing Model (HPM) and Artificial Neural Network (ANN) model in predicting the residential land price for Chengalpattu district, a suburban region in the southern part of India. Residential land prices and data for the variables affecting land prices were collected and used to develop the HPM and ANN models. Subsequently, both models predicted land prices for newer land parcels, and their accuracy was compared. The performance evaluation indices of root mean square error (RMSE), mean absolute error (MAE), mean absolute percentage error (MAPE), R-square and accuracy were calculated for the predicted results of both the models. The HPM predicted the residential land prices with an accuracy of 75 %, whereas the ANN model predicted the prices with an accuracy of 91 %. The study showed that the ANN model is reliable and accurate in residential price prediction for suburban regions.

Downloads

References

C. B. Goodman, “The Fiscal Impacts of Urban Sprawl: Evidence from U.S. County Areas,” Ssrn, no. 402, 2011.

W. Z. Taffese, “Case-based reasoning and neural networks for real estate valuation,” Proc. IASTED Int. Conf. Artif. Intell. Appl. AIA 2007, no. February 2007, pp. 84–89, 2007.

V. Sampathkumar, M. H. Santhi, and J. Vanjinathan, “Forecasting the Land Price Using Statistical and Neural Network Software,” Procedia Comput. Sci., vol. 57, pp. 112–121, 2015.

E. Pagourtzi, V. Assimakopoulos, and T. Hatzichristos, “Real estate appraisal : a review of valuation methods,” vol. 21, no. 4, pp. 383–401, 2003.

V. Limsombunchai, “House Price Prediction : Hedonic Price Model vs . Artificial Neural Network Paper presented at the 2004 NZARES Conference House Price Prediction :,” 2004.

R. B. Abidoye and A. P. C. Chan, “Hedonic Valuation of Real Estate Properties in Nigeria, Hedonic Valuation of Properties in Nigeria,” J. African Real Estate Res., vol. 3, no. 1, pp. 122–140, 2018.

T. Hussain, J. Abbas, Z. Wei, and M. Nurunnabi, “The effect of sustainable urban planning and slum disamenity on the value of neighboring residential property: Application of the hedonic pricing model in rent price appraisal,” Sustain., vol. 11, no. 4, pp. 1–20, 2019.

M. Monson, “Valuation Using Hedonic Pricing Models Valuation,” Cornell Real Estate Rev., vol. 7, pp. 62–73, 2009.

S. Malpezzi, “Hedonic Pricing Models: A Selective and Applied Review,” Hous. Econ. Public Policy, no. 1999, pp. 67–89, 2008.

Linda R. Musser. (2020). Older Engineering Books are Open Educational Resources. Journal of Online Engineering Education, 11(2), 08–10. Retrieved from http://onlineengineeringeducation.com/index.php/joee/article/view/41

Patil, V. N., & Ingle, D. R. (2022). A Novel Approach for ABO Blood Group Prediction using Fingerprint through Optimized Convolutional Neural Network. International Journal of Intelligent Systems and Applications in Engineering, 10(1), 60–68. https://doi.org/10.18201/ijisae.2022.268

L. Moreno-Izquierdo, G. Egorova, A. Peretó-Rovira, and A. Más-Ferrando, “Exploring the use of artificial intelligence in price maximisation in the tourism sector: Its application in the case of Airbnb in the Valencian Community,” Investig. Reg., vol. 2018, no. 42, pp. 113–128, 2018.

C. H. R. Madhuri, G. Anuradha, and M. V. Pujitha, “House Price Prediction Using Regression Techniques: A Comparative Study,” 6th IEEE Int. Conf. "Smart Struct. Syst. ICSSS 2019, pp. 1–5, 2019.

Jang Bahadur, D. K. ., and L. . Lakshmanan. “Virtual Infrastructure Based Routing Algorithm for IoT Enabled Wireless Sensor Networks With Mobile Gateway”. International Journal on Recent and Innovation Trends in Computing and Communication, vol. 10, no. 8, Aug. 2022, pp. 96-103, doi:10.17762/ijritcc.v10i8.5681.

M. D. Mankad, “Comparing OLS based hedonic model and ANN in house price estimation using relative location,” Spat. Inf. Res., vol. 30, no. 1, pp. 107–116, 2022.

W. C. Wang, Y. J. Chang, and H. C. Wang, “An application of the spatial autocorrelation method on the change of real estate prices in Taitung city,” ISPRS Int. J. Geo-Information, vol. 8, no. 6, 2019.

A. Cechin, A. Souto, and M. Aurélio González, “Real estate value at Porto Alegre city using artificial neural networks,” Proc. - Brazilian Symp. Neural Networks, SBRN, vol. 2000-Janua, pp. 237–242, 2000.

J. X. Ge, G. Runeson, and K. C. Lam, “Forecasting Hong Kong Housing Prices: An Artificial Neural Network Approach,” Int. Conf. Methodol. Hous. Res., no. September 2015, 2003.

J. G. Mora-esperanza, “ARTIFICIAL INTELLIGENCE APPLIED An example for the appraisal of Madrid,” pp. 255–265, 2004.

J. D. Ruben, “Data Mining : An Empirical Application in Real Estate Valuation,” Proc. Fifteenth Int. Florida Artif. Intell. Res. Soc. Conf., pp. 314–317, 2002.

A. Mimis, A. Rovolis, and M. Stamou, “Property valuation with artificial neural network: The case of Athens,” J. Prop. Res., vol. 30, no. 2, pp. 128–143, 2013.

W. Z. Taffese, “A Survey on Application of Artificial Intelligence in Real Estate Industry,” no. November 2006, 2014.

E. M. Worzala, R. Johnson, C. M. Lizieri, and L. Soenen, “Hedging Private International Real Estate,” no. January 2009, 2009.

J. Ćetković et al., “Assessment of the Real Estate Market Value in the European Market by Artificial Neural Networks Application,” Complexity, vol. 2018, 2018.

S. Openshaw, “Neural network, genetic, and fuzzy logic models of spatial interaction,” Environ. Plan. A, vol. 30, no. 10, pp. 1857–1872, 1998.

R. B. Abidoye and A. P. C. Chan, “Improving property valuation accuracy: A comparison of hedonic pricing model and artificial neural network,” Pacific Rim Prop. Res. J., vol. 24, no. 1, pp. 71–83, 2018.

K. C. Lam, C. Y. Yu, and K. Y. Lam, “An artificial neural network and entropy model for residential property price forecasting in Hong Kong,” J. Prop. Res., vol. 25, no. 4, pp. 321–342, 2008.

F. Tajani, P. Morano, and K. Ntalianis, “Automated valuation models for real estate portfolios: A method for the value updates of the property assets,” J. Prop. Invest. Financ., vol. 36, no. 4, pp. 324–347, 2018.

Ş. Yalpır, “Enhancement of parcel valuation with adaptive artificial neural network modeling,” Artif. Intell. Rev., vol. 49, no. 3, pp. 393–405, Mar. 2018.

J. M. Núñez-Tabales, F. J. Rey-Carmona, and J. M. Caridad Y Ocerin, “Commercial properties prices appraisal: Alternative approach based on neural networks,” Int. J. Artif. Intell., vol. 14, no. 1, pp. 53–70, 2016.

J. Núñez Tabales, F. Rey Carmona, and J. M. Caridad Y Ocerin, “Implicit prices in urban real estate valuation,” Rev. la Constr., vol. 12, no. 2, pp. 116–126, 2013.

J. S. Chou, D. B. Fleshman, and D. N. Truong, Comparison of machine learning models to provide preliminary forecasts of real estate prices, no. 0123456789. Springer Netherlands, 2022.

T. H. Kuethe, B. Brewer, and C. Fiechter, “Loss Aversion in Farmland Price Expectations,” Land Econ., vol. 98, no. 1, pp. 98–114, 2022.

Gupta, D. J. . (2022). A Study on Various Cloud Computing Technologies, Implementation Process, Categories and Application Use in Organisation. International Journal on Future Revolution in Computer Science &Amp; Communication Engineering, 8(1), 09–12. https://doi.org/10.17762/ijfrcsce.v8i1.2064

M. Štubňová, M. Urbaníková, J. Hudáková, and V. Papcunová, “Estimation of residential property market price: comparison of artificial neural networks and hedonic pricing model,” Emerg. Sci. J., vol. 4, no. 6, pp. 530–538, 2020.

S. Peterson and A. B. Flanagan, “Neural network hedonic pricing models in mass real estate appraisal,” J. Real Estate Res., vol. 31, no. 2, pp. 147–164, 2009.

R. Grover, “Mass valuations,” J. Prop. Invest. Financ., vol. 34, no. 2, pp. 191–204, 2016.

T. T. Dugeri, “an Evaluation of the Maturity of the Nigerian Property Market By,” no. 029053002, 2011.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All papers should be submitted electronically. All submitted manuscripts must be original work that is not under submission at another journal or under consideration for publication in another form, such as a monograph or chapter of a book. Authors of submitted papers are obligated not to submit their paper for publication elsewhere until an editorial decision is rendered on their submission. Further, authors of accepted papers are prohibited from publishing the results in other publications that appear before the paper is published in the Journal unless they receive approval for doing so from the Editor-In-Chief.

IJISAE open access articles are licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. This license lets the audience to give appropriate credit, provide a link to the license, and indicate if changes were made and if they remix, transform, or build upon the material, they must distribute contributions under the same license as the original.