Prediction Model Estimation and Dynamic Characteristics Analysis of Exchange Rate and KOSDAQ Index

Keywords:

VAR, VECM, Granger causality test, Cointegration test, Impulse response functionAbstract

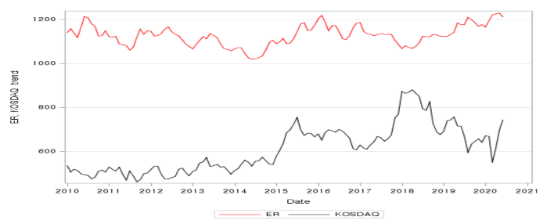

In this study, a predictive model based on vector autoregressive model (VAR) was estimated using monthly multivariate time series data of exchange rate (ER) and KOSDAQ index (KOSDAQ), and dynamic characteristics analysis of ER and KOSDAQ using impulse response function was carried out. To this end, the ADF unit root test was performed to confirm the stability of the data, the linear dependence relationship between variables was examined by the Granger causality test, and the existence of a constant term was confirmed by the t-statistic. The VAR model was identified using the AICC statistic of the minimum information criterion. In order to avoid spurious regression of the identified model, the cointegration test was performed for the cases that the error correction term had a constant intercept and that the VECM(p) term had a constant intercept and no linear trend. And it was found that the cointegration coefficient did not exist. Therefore, the prediction model of ER and the KOSDAQ could be estimated by the VAR model. As a result of the prediction, ER and KOSDAQ were predicted to remain stable after about 3 months. And the dynamic response in the forecasting model was evaluated using the impulse response function. As a result of the analysis, it was analyzed that when the shock of ER occurred, the effect of the shock disappeared after about 8 months in KOSDAQ, and that when the shock of KOSDAQ occurred, the effect of the shock disappeared after about 5 months in ER.

Downloads

References

Ehlers, T. and Takáts, E., Capital Flow Dynamics and FX Intervention. In Bank for International Settlements (Ed.), Sovereign Risk: A World without Risk-free Assets?, Bank for International Settlements., 73 (2013), 25-38.

Cho, C. G., Examining the Interaction among Stock Prices and Exchange Rates of Home and Foreign Countries: Identification through Heteroscedasticity. The Journal of International Trade & Commerce., 12 (2016), 411-432.

N. A. Libre. (2021). A Discussion Platform for Enhancing Students Interaction in the Online Education. Journal of Online Engineering Education, 12(2), 07–12. Retrieved from http://onlineengineeringeducation.com/index.php/joee/article/view/49

Pyo, H. K. and Oh. S. H., A Short-Term Export Forecasting Model Using Input-Output Tables. KIEP Research Paper Working Papers 16-02, Korea Institute for International Economic Policy., 2016.

Kim, J. I., A Study on the Correlation between Social Contribution Companies and Stock Index in Korea. Journal of CEO and Management Studies., 23-1 (2020), 151-165.

Kim, J. I. and Kim S. R., A Study on Interrelation between Korea's Global Company and KOSPI Index. Journal of CEO and Management Studies., 21-3 (2018), 131-15.

Kim, J. i. and Rhee, T. H., A Study on the Correlation between Stock Price of Sustainability Management Companies and KOSPI Index. Journal of CEO and Management Studies., 20-4 (2017), 485-504.

Yadav, P. ., S. . Kumar, and D. K. J. . Saini. “A Novel Method of Butterfly Optimization Algorithm for Load Balancing in Cloud Computing”. International Journal on Recent and Innovation Trends in Computing and Communication, vol. 10, no. 8, Aug. 2022, pp. 110-5, doi:10.17762/ijritcc.v10i8.5683.

Fabrizi, E., Ferrante, M. R. and Trivisano, C., Bayesian small area estimation for skewed business survey variables. Journal of the Royal Statistical Society., 67-4 (2018), 861-879.

EL-YAHYAOUI, A., & OMARY, F. (2022). An improved Framework for Biometric Database’s privacy. International Journal of Communication Networks and Information Security (IJCNIS), 13(3). https://doi.org/10.17762/ijcnis.v13i3.5143

Vermeulen, P., An evaluation of business survey indices for short-term forecasting: Balance method versus Carlson–Parkin method. International Journal of Forecasting., 30-4 (2014), 882-897.

Toda, H. Y. and T. Yamamoto., Statistical inference in vector autoregressions with possible integrated processes. Journal of Econometrics., 66 (1995), 225-250.

Ravita, R., & Rathi, S. (2022). Inductive Learning Approach in Job Recommendation. International Journal of Intelligent Systems and Applications in Engineering, 10(2), 242–251. Retrieved from https://ijisae.org/index.php/IJISAE/article/view/1829

Dolado, J. and H. Lutkepohy., Making Wald Tests Work for Cointegrated VAR Systems. Econometric Reviews., 15-4 (1996), 369-286.

Johansen, S., Asymptotic Inference on Cointergrating Rank in Partial Systems. Journal of Business and Economic Statistics., 16 (1998), 388-399.

Johansen, S., A Statistical Analysis of Cointegration for I(2) Vaiables. Econometric Theory., 11 (1995), 25-59.

Box, G. E. and G. M Jenkins., Time series analysis: forecasting and control, revised ed. Holden-Day., 1976.

Hamilton, J. D., Time series analysis (Vol. 2). Princeton: Princeton university press., 1994.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All papers should be submitted electronically. All submitted manuscripts must be original work that is not under submission at another journal or under consideration for publication in another form, such as a monograph or chapter of a book. Authors of submitted papers are obligated not to submit their paper for publication elsewhere until an editorial decision is rendered on their submission. Further, authors of accepted papers are prohibited from publishing the results in other publications that appear before the paper is published in the Journal unless they receive approval for doing so from the Editor-In-Chief.

IJISAE open access articles are licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. This license lets the audience to give appropriate credit, provide a link to the license, and indicate if changes were made and if they remix, transform, or build upon the material, they must distribute contributions under the same license as the original.