Stock Market Prediction With Risk Analysis Using Two ml Module

Keywords:

Prediction, Machine learning, Stock market trend, Feature engineering, risk analysisAbstract

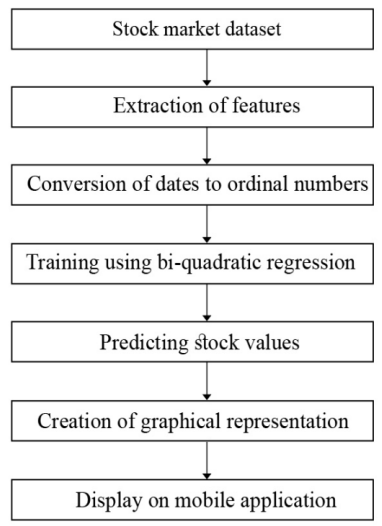

Attempts to predict movements in stock prices have historically proven difficult for academic researchers. Seminal publications in the literature have shown that the seemingly random movement patterns of stock price time series may be anticipated with a high degree of accuracy, contrary to the claims of proponents of the efficient market theory. Such risk-adjusted prediction models require appropriate variable selection, variable transformation processes, and model parameter adjustment. This study proposes a methodology for predicting stock prices using a combination of statistical analysis and machine learning that is both predictable and accurate in its risk analysis. We utilize five-minutely daily stock price data from a major company listed on India's National Stock Exchange (NSE). When building and training forecasting models, the granular data is aggregated into various time slots throughout the day. We propose that agglomerative model development, combining statistical and machine learning approaches, may successfully learn from unpredictable and erratic movement patterns in stock price data while mitigating risk. Using this effective learning, models can be trained to be robust and low-risk, increasing their utility for predicting stock movement patterns and short-term stock prices. Regression and classification models are built using statistical and machine-learning techniques. A large amount of data on these models' efficacy has been provided and thoroughly examined.

Downloads

References

M. Raddant, D.Y. Kenett, Interconnectedness in the global fnancial market. J. Int. Money Finance 110, 102280 (2021)

J. Zhao, M. Shahbaz, X. Dong et al., How does fnancial risk afect global CO2 emissions? The role of technological innovation. Technol. Forecast. Soc. Change 168, 120751 (2021) optimization algorithm for multimodal multi-objective optimization. Swarm Evolut. Comput. 62, 100843 (2021)

A. Kim, Y. Yang, S. Lessmann et al., Can deep learning predict risky retail investors? A case study in fnancial risk behavior forecasting. Eur. J. Oper. Res. 283(1), 217–234 (2020)

K.T. Chui, D.C.L. Fung, M.D. Lytras et al., Predicting at-risk university students in a virtual learning environment via a machine learning algorithm. Comput. Hum. Behav. 107, 105584 (2020)

T.S. Kumar, Data mining based marketing decision support system using hybrid machine learning algorithm. J. Artif. Intell. 2(03), 185–193 (2020)

Y. Chen, S. Hu, H. Mao et al., Application of the best evacuation model of deep learning in the design of public structures. Image Vis. Comput. 102, 103975 (2020)

Q. Wang, M. Su, Integrating blockchain technology into the energy sector—from theory of blockchain to research and application of energy blockchain. Comput. Sci. Rev. 37, 100275 (2020)

A.M. Acquah, M. Ibrahim, Foreign direct investment, economic growth and fnancial sector development in Africa. J. Sustain. Finance Invest. 10(4), 315–334 (2020)

B.M. Henrique, V.A. Sobreiro, H. Kimura, Literature review: Machine learning techniques applied to fnancial market prediction. Expert Syst. Appl. 124, 226–251 (2019)

M. Andoni, V. Robu, D. Flynn et al., Blockchain technology in the energy sector: a systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 100, 143–174 (2019)

Q. Yang, Y. Wang, Y. Ren, Research on fnancial risk management model of internet supply chain based on data science. Cogn. Syst. Res. 56, 50–55 (2019)

A.A. Nagra, F. Han, Q.H. Ling et al., An improved hybrid method combining gravitational search algorithm with dynamic multi swarm particle swarm optimization. IEEE Access 7, 50388–50399 (2019)

J.L. Speiser, M.E. Miller, J. Tooze et al., A comparison of random forest variable selection methods for classifcation prediction modeling. Expert Syst. Appl. 134, 93–101 (2019)

R. Janani, S. Vijayarani, Text document clustering using spectral clustering algorithm with particle swarm optimization. Expert Syst. Appl. 134, 192–200 (2019)

T. Fischer, C. Krauss, Deep learning with long short-term memory networks for fnancial market predictions. Eur. J. Oper. Res. 270(2), 654–669 (2018)

M. Azam, S.A. Raza, Financial sector development and income inequality in ASEAN-5 countries: does fnancial Kuznets curve exists? Global Bus. Econ. Rev. 20(1), 88–114 (2018)

C. Alexiou, S. Vogiazas, J.G. Nellis, Reassessing the relationship between the fnancial sector and economic growth: dynamic panel evidence. Int. J. Financ. Econ. 23(2), 155–173 (2018)

H. Pollitt, J.F. Mercure, The role of money and the fnancial sector in energy-economy models used for assessing climate and energy policy. Clim. Policy 18(2), 184–197 (2018)

G. Chen, B. Xu, M. Lu et al., Exploring blockchain technology and its potential applications for education. Smart Learn. Environ. 5(1), 1–10 (2018)

A.J. Asaleye, J.I. Adama, J.O. Ogunjobi, Financial sector and manufacturing sector performance: evidence from Nigeria. Invest. Manag. Financ. Innov. 15(3), 35–48 (2018)

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All papers should be submitted electronically. All submitted manuscripts must be original work that is not under submission at another journal or under consideration for publication in another form, such as a monograph or chapter of a book. Authors of submitted papers are obligated not to submit their paper for publication elsewhere until an editorial decision is rendered on their submission. Further, authors of accepted papers are prohibited from publishing the results in other publications that appear before the paper is published in the Journal unless they receive approval for doing so from the Editor-In-Chief.

IJISAE open access articles are licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. This license lets the audience to give appropriate credit, provide a link to the license, and indicate if changes were made and if they remix, transform, or build upon the material, they must distribute contributions under the same license as the original.