Expert Systems in Banking: Artificial Intelligence Application in Supporting Banking Decision-Making

Keywords:

Decision-making, expert system, qualitative variables, guarantee variablesAbstract

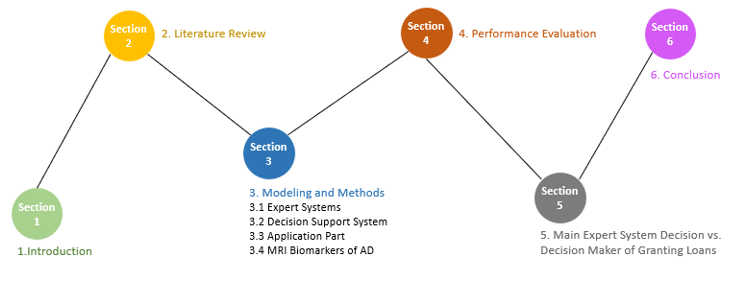

This paper aims to evaluate the role of artificial intelligence in the bank lending process. A field study is conducted at the level of several banks. The article focuses on loan files of a commercial and productive nature. To achieve our goal, we utilized multiple expert systems: Sub expert system 1, Sub expert system 2 and the main expert system. Accordingly, the linguistic variables of the proposed expert systems were subsumed into qualitative variables and confirmation variables. To access the decision-making process for granting or denying the loan, the outputs of these variables of sub-expert systems 1 and 2 are fed as inputs to the main expert system. To achieve banking business success factors (quality and time), the expert systems improve the quality of banking service provided. It is performed by reducing the number and size of financial and non-financial errors and their ability to detect error cases. Additionally, unlike the human element, expert systems are characterized by their speed in executing the orders required of them in a few moments, which reduces the time required for decision-making.

Downloads

References

Alrashidi, M., Almutairi, A., & Zraqat, O. “The impact of big data analytics on audit procedures: Evidence from the Middle East”. The Journal of Asian Finance, Economics, and Business, 9(2), 93–102,2022.

Taguimdje, S. L., Wamba, S. F., Kamdjoug, J. R. K., & Wanko, C. E. T. “Influence of artificial intelligence (AI) on firm performance: The business value of AI-based transformation projects” Business Process Management Journal, 11, 56–79,2020.

Kamble, R., & Shah, D. “Applications of artificial intelligence in human life”. International Journal of Research- GRANTHAALAYAH, 6(6), 178–188,2018.

Cockburn, I. M., Henderson, R., & Stern, S. “The impact of artificial intelligence on innovation”. International Journal of Information Management, 48, 63–71,2018.

Christina, A. R., Asmaa, S. E."A Proposed Expert System for Evaluating the Partnership in Banks". International Journal of Advance Robotics & Expert Systems (JARES), 1, (2),1-12,2017.

Sudhakar, M.; and Reddy, C.V.K. "Two-step credit risk assessment model for retail bank loan applications using decision tree data mining technique". International Journal of Advanced Research in Computer Engineering and Technology, 5(3), 705-718,2016.

Srivastava, S.; Saranya, G.; Pratap, A.; Agrawal, R.; and Jain, A. "Loan default prediction using artificial neural networks". International Journal of Advanced Science and Technology, 29(6), 2761-2769,2020.

Aslam, U.; Aziz, H.I.T.; Sohail, A; and Batcha, N.K. "An empirical study on loan default prediction models". Journal of Computational and Theoretical Nanoscience, 16(8), 3483-3488,2020.

Obare, D.M.; Njoroge, G.G.; and Muraya, M.M. "Analysis of individual loan defaults using logit under supervised machine learning approach". Asian Journal of Probability and Statistics, 3(4), 1-12,2019.

Tariq, H.I.; Sohail, A; Aslam, U.; and Batcha, N.K. "Loan default prediction model using sample, explore, modify, model, and assess". Journal of Computational and Theoretical Nanoscience, 16(8), 3489-3503,2019.

Kumar, M.; Goel, V.; Jain, T.; Singhal, S.; and Goel L.M. "Neural network approach to loan default prediction". International Research Journal of Engineering and Technology (IRJET), 5(4), 4231-4234,2018.

Bui, D. K., Nguyen, T. N., Ngo, T. D., & Nguyen-Xuan, H. "An artificial neural network (ANN) expert system enhanced with the electromagnetism-based firefly algorithm" (EFA) for predicting the energy consumption in buildings. Energy190(C),2020.

Khalil, A. M., Li, S. G., Lin, Y., Li, H. X., & Ma, S. G. "A new expert system in the prediction of lung cancer disease based on fuzzy soft sets". Soft Computing, 1(1), 1–29,2020.

Rynah, R. "An Expert System for Disbursement Of Home Loans". International Journal of Technical Research and Applications, 3(5), 142-148, 2015.

Marion, O. A., Oluwasemilore, O. A., Roseline, O. O., & Julius, O. O., Ayodele, A. A. " Secured Loan Prediction System Using Artificial Neural Network". Journal of Engineering Science and Technology, Vol. 17, No. 2,0854 - 0873,2022.

MYA, M., " Loan Applicants Selection And Ranking System For Private Banks In Myanmar Using TOPSIS". M.C.Sc. Thesis, January, 2020.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All papers should be submitted electronically. All submitted manuscripts must be original work that is not under submission at another journal or under consideration for publication in another form, such as a monograph or chapter of a book. Authors of submitted papers are obligated not to submit their paper for publication elsewhere until an editorial decision is rendered on their submission. Further, authors of accepted papers are prohibited from publishing the results in other publications that appear before the paper is published in the Journal unless they receive approval for doing so from the Editor-In-Chief.

IJISAE open access articles are licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. This license lets the audience to give appropriate credit, provide a link to the license, and indicate if changes were made and if they remix, transform, or build upon the material, they must distribute contributions under the same license as the original.