Scoring of Borrowers Solvability by SVM and MLP hybridized to GA: Evidence from Banking Dataset

Keywords:

Credit scoring, Machine Learning, Optimization, Solvability, BankingAbstract

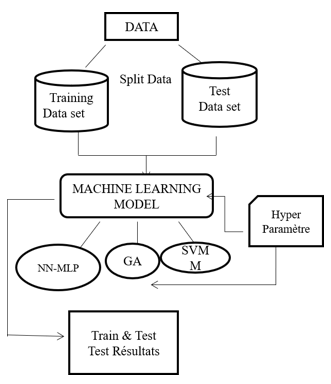

In this paper, we treat the problem of credit default risk or risk of non-repayment in banks using credit scoring models. As the methods currently used have some gaps in predicting the solvency of loan applicants, which could cause in losses for the banks, our contribution is to propose a new credit scoring method based on Machine Learning algorithms. We adopt two strategies: first, we hybridize Genetic Algorithms (GA) with Support Vector Machine (SVM) and Multi-Layer Perceptron (MLP) to evaluate impact of GA on prediction performance; and second, we test SVM and MLP with their hyperparameters, and then hybridize MLP with Artificial Neural Network (ANN). To compare our method with the methods proposed in [28], we realized simulations using Python on our banking dataset. The generated results show that the hybridization with GA yields less significant results compared to the strategy of SVM, MLP with their hyperparameters, and MLP-ANN that generate the improved values of AUC, Accuracy, confusion matrix and F1-Score compared to [28]. Furthermore, even for our database the same metrics is also significant with best values.

Downloads

References

J. Andersson, L. Baresi, N. Bencomo, R. Lemos, A. Gorla, P. Inverardi and T. Vogel, "Software Engineering Processes for Self-Adaptive Systems," in Software Engineering for Self-Adaptive Systems II, Springer, 2013, pp. 51-75.

K. K. Ganguly and K. Sakib, "Decentralization of Control Loop for Self-Adaptive Software through Reinforcement Learning," in 24th Asia-Pacific Software Engineering Conference Workshops (APSECW), Nanjing, China, 2017.

Abellán J, Mantas CJ. Improving experimental studies about ensembles of classifiers for bankruptcy prediction and credit scoring. Expert Systems with Applications. 2014 Jun 15;41(8):3825-30.

Al-Mudimigh, A. and Anshari, M., 2020. Financial technology and innovative financial inclusion. In Financial technology and disruptive innovation in ASEAN (pp. 119-129). IGI Global.

Birkenmaier, J., Despard, M., Friedline, T. and Huang, J., 2019. Financial inclusion and financial access. In Encyclopedia of social work.

Chatterjee, S. and Barcun, S., 1970. A nonparametric approach to credit screening. Journal of the American statistical Association, 65(329), pp.150-154. Chatterjee, S. and Barcun, S., 1970. A nonparametric approach to credit screening. Journal of the American statistical Association, 65(329), pp.150-154.

Chen, W., Sun, Z., Wang, X.J., Jiang, T., Huang, Z., Fang, D. and Zhang, D.D., 2009. Direct interaction between Nrf2 and p21Cip1/WAF1 upregulates the Nrf2-mediated antioxidant response. Molecular cell, 34(6), pp.663-673.

Chopra, A. and Bhilare, P., 2018. Application of ensemble models in credit scoring models. Business Perspectives and Research, 6(2), pp.129-141.

Durai, T. and Stella, G., 2019. Digital finance and its impact on financial inclusion. Journal of Emerging Technologies and Innovative Research, 6(1), pp.122-127.

Egan, J.P. and Egan, J.P., 1975. Signal detection theory and ROC-analysis. Academic press.

Frolova, E.E., Ermakova, E.P. and Protopopova, O.V., 2020, March. Consumer protection of digital financial services in Russia and abroad. In 13th International Scientific and Practical Conference-Artificial Intelligence Anthropogenic nature Vs. Social Origin (pp. 76-87). Springer, Cham.

Prabakaran. D and S. Ramachandran, "Secure Key Generation from Speech signal Using Enhanced MFCC Algorithm," 2021 IEEE International Conference on Mobile Networks and Wireless Communications (ICMNWC), Tumkur, Karnataka, India, 2021, pp. 1-5, doi: 10.1109/ICMNWC52512.2021.9688398..

Huang, C.L., Chen, M.C. and Wang, C.J., 2007. Credit scoring with a data mining approach based on support vector machines. Expert systems with applications, 33(4), pp.847-856.

Kavzoglu, T. and Mather, P.M., 2003. The use of backpropagating artificial neural networks in land cover classification. International journal of remote sensing, 24(23), pp.4907-4938.

Li, G., Klein, B., Sun, C. and Kou, J., 2020. Applying Receiver-Operating-Characteristic (ROC) to bulk ore sorting using XRF. Minerals Engineering, 146, p.106117.

Nehrebecka, N., 2018. Predicting the default risk of companies. Comparison of credit scoring models: LOGIT vs Support Vector Machines. Ekonometria, 22(2), pp.54-73.

Nguyen, H., Bui, X.N., Tran, Q.H. and Moayedi, H., 2019. Predicting blast-induced peak particle velocity using BGAMs, ANN and SVM: A case study at the Nui Beo open-pit coal mine in Vietnam. Environmental earth sciences, 78(15), pp.1-14.

Shyamala, R., and D. Prabakaran. "A survey on security issues and solutions in virtual private network." International Journal of Pure and Applied Mathematics 119.15 (2018): 3115-3122.

Pławiak, P., Abdar, M. and Acharya, U.R., 2019. Application of new deep genetic cascade ensemble of SVM classifiers to predict the Australian credit scoring. Applied Soft Computing, 84, p.105740.

Qu, Y., Quan, P., Lei, M. and Shi, Y., 2019. Review of bankruptcy prediction using machine learning and deep learning techniques. Procedia Computer Science, 162, pp.895-899.

Sadowski, C., Söderberg, E., Church, L., Sipko, M. and Bacchelli, A., 2018, May. Modern code review: a case study at google. In Proceedings of the 40th International Conference on Software Engineering: Software Engineering in Practice (pp. 181-190).

Schölkopf, B., Smola, A.J., Williamson, R.C. and Bartlett, P.L., 2000. New support vector algorithms. Neural computation, 12(5), pp.1207-1245.

Tien Bui, D., Tuan, T.A., Hoang, N.D., Thanh, N.Q., Nguyen, D.B., Van Liem, N. and Pradhan, B., 2017. Spatial prediction of rainfall-induced landslides for the Lao Cai area (Vietnam) using a hybrid intelligent approach of least squares support vector machines inference model and artificial bee colony optimization. Landslides, 14(2), pp.447-458.

Tien Bui, D., Tuan, T.A., Klempe, H., Pradhan, B. and Revhaug, I., 2016. Spatial prediction models for shallow landslide hazards: a comparative assessment of the efficacy of support vector machines, artificial neural networks, kernel logistic regression, and logistic model tree. Landslides, 13(2), pp.361-378.

Van Gestel, T., Suykens, J.A., Baesens, B., Viaene, S., Vanthienen, J., Dedene, G., De Moor, B. and Vandewalle, J., 2004. Benchmarking least squares support vector machine classifiers. Machine learning, 54(1), pp.5-32.

Vanatta, S.H., 2018. Making Credit Convenient: Credit Cards and the Political Economy of Modern America.

Vapnik, V., 1998. The support vector method of function estimation. In Nonlinear modeling (pp. 55-85). Springer, Boston, MA.

D. Prabakaran and S. Ramachandran, "Multi-factor authentication for secured financial transactions in cloud environment," Computers, Materials & Continua, vol. 70, no.1, pp. 1781–1798, 2022.

Zhu, Y.F. and Mao, Z.Y., 2004, December. Online optimal modeling of LS-SVM based on time window. In 2004 IEEE International Conference on Industrial Technology, 2004. IEEE ICIT'04. (Vol. 3, pp. 1325-1330). IEEE.

Michael Bücker Journal of Banking & Finance Volume 37, Issue 3, March 2013, Pages 1040-1045.

ACPR, (2018), Intelligence artifcielle : enjeux pour le secteur financier, Document de réflexion, DÈcembre 2018

] Varian, H.R., (2014), Big data : New tricks for econometrics, Journal of Economic Perspectives, 28, 3-28.

Anderson, R. The Credit Scoring Toolkit: Theory and Practice for Retail Credit RiskManagement and Decision Automation. New York, Oxford University Press, 2007.

Downloads

Published

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All papers should be submitted electronically. All submitted manuscripts must be original work that is not under submission at another journal or under consideration for publication in another form, such as a monograph or chapter of a book. Authors of submitted papers are obligated not to submit their paper for publication elsewhere until an editorial decision is rendered on their submission. Further, authors of accepted papers are prohibited from publishing the results in other publications that appear before the paper is published in the Journal unless they receive approval for doing so from the Editor-In-Chief.

IJISAE open access articles are licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. This license lets the audience to give appropriate credit, provide a link to the license, and indicate if changes were made and if they remix, transform, or build upon the material, they must distribute contributions under the same license as the original.