Bitcoin Price Prediction Using Sentiment Analysis and Long Short-Term Memory (LSTM)

Keywords:

Twitter Sentiment analysis, LSTM, Bitcoin, forecastAbstract

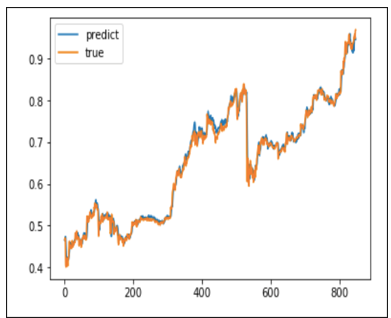

Bitcoin is steadily gaining popularity online and expanding its use in a wide range of transactions. The sentiments are the main driver of its pricing, which is very sensitive. Gains would increase as forecasting accuracy improves. Although there are many statistical methods for predicting prices, accuracy still needs improvement. This research aims to increase the forecast precision of Bitcoin price movements. The volume, polarity, and price variables of the data set have been added by including a new field called sentiment in order to achieve this goal. Twitter is used to determine sentiment, which is then included in the data collection. This work has suggested a dynamic sentiment analysis strategy that uses the long short-term memory (LSTM) to forecast prices with greater accuracy. Prior to and after the sentiment components were incorporated into the data set, prices were forecasted. The incorporation of mood has a beneficial effect on forecast accuracy, according to the findings. As a result, our approach can significantly reduce risk that is brought on by the high fluctuation of the price of bitcoin.

Downloads

References

McNally, S., Roche, J., & Caton, S. (2018). Predicting the Price of Bitcoin Using Machine Learning. 2018 26th Euromicro International Conference on Parallel, Distributed and Network-Based Processing (PDP), 339–343. https://doi.org/10.1109/PDP2018.2018.00060

J. Guo, C. Li, G. Zhang, Y. Sun, and R. Bie, “Blockchain-enabled digital rights management for multimedia resources of online education,” Multimed. Tools Appl., vol. 79, no. 15–16, 2020, doi: 10.1007/s11042-019-08059-1.

E. Kouloumpis, T. Wilson, and J. Moore, “Twitter Sentiment Analysis: The Good the Bad and the OMG!”, ICWSM, vol. 5, no. 1, pp. 538-541, Aug. 2021.

Wang, Q., & Chong, T. T. L. (2021). Factor pricing of cryptocurrencies. The North American Journal of Economics and Finance, 57, 101348. https://doi.org/10.1016/J.NAJEF.2020.101348.

Mukiri, R. kumari, & Vijaya Babu, B. (2021). Prediction of rumour source identification through spam detection on social Networks- A survey. Materials Today: Proceedings. https://doi.org/10.1016/J.MATPR.2021.03.367

L. Cocco, R. Tonelli, and M. Marchesi, “Predictions of bitcoin prices through machine learning based frameworks,” PeerJ Comput. Sci., vol. 7, pp. 1–23, 2021, doi: 10.7717/PEERJ-CS.413.

B. Pang and L. Lee, “Opinion mining and sentiment analysis,” Foundations and Trends in Information Retrieval, vol. 2, no. 2. pp. 1–135, 2008.

Chhabra, G. (2023). Comparison of Imputation Methods for Univariate Time Series. International Journal on Recent and Innovation Trends in Computing and Communication, 11(2s), 286–292. https://doi.org/10.17762/ijritcc.v11i2s.6148

P. Nakov, A. Ritter, S. Rosenthal, F. Sebastiani, and V. Stoyanov, “SemEval-2016 Task 4: Sentiment Analysis in Twitter,” in Proceedings of the 10th International Workshop on Semantic Evaluation (SemEval-2016), 2016, pp. 1–18. doi: 10.18653/v1/S16-1001.

G. P. Dwyer, “The economics of Bitcoin and similar private digital currencies,” J. Financ. Stab., vol. 17, pp. 81–91, Apr. 2015, doi: 10.1016/j.jfs.2014.11.006.

A. Agarwal, B. Xie, I. Vovsha, O. Rambow, and R. Passonneau, “Sentiment Analysis of Twitter Data.” Association for Computational Linguistics, pp. 30–38, 2011. [Online]. Available: http://www.webconfs.com/stop-words.php

E. Stenqvist and J. Lönnö, “Predicting Bitcoin price fluctuation with Twitter sentiment analysis,” degree project technology. 2017.

S. Colianni, S. Rosales, M. S.-C. Project, and undefined 2015, “Algorithmic trading of cryptocurrency based on Twitter sentiment analysis,” cs229.stanford.edu, Accessed: Sep. 28, 2022. [Online]. Available: http://cs229.stanford.edu/proj2015/029_report.pdf

P. Paroubek and A. Pak, “Twitter as a Corpus for Sentiment Analysis and Opinion Mining.” 2010. [Online]. Available: http://tumblr.com

Y. Ma, H. Peng, T. Khan, E. Cambria, and A. Hussain, “Sentic LSTM: a Hybrid Network for Targeted Aspect-Based Sentiment Analysis,” Cognit. Comput., vol. 10, no. 4, pp. 639–650, Aug. 2018, doi: 10.1007/s12559-018-9549-x.

A. M. Alayba, V. Palade, M. England, and R. Iqbal, “A combined CNN and LSTM model for Arabic sentiment analysis,” in Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics), 2018, vol. 11015 LNCS, pp. 179–191. doi: 10.1007/978-3-319-99740-7_12.

Mokni, K., Bouteska, A., & Nakhli, M. S. (2022). Investor sentiment and Bitcoin relationship: A quantile-based analysis. The North American Journal of Economics and Finance, 60, 101657. https://doi.org/10.1016/J.NAJEF.2022.101657

M. Bhuvana and S. Vasantha, “Mediating effect of demonetization of currency notes towards adopting cashless payment system,” Int. J. Civ. Eng. Technol., vol. 8, no. 6, pp. 699–707, 2017.

M. Giatsoglou, M. G. Vozalis, K. Diamantaras, A. Vakali, G. Sarigiannidis, and K. C. Chatzisavvas, “Sentiment analysis leveraging emotions and word embeddings,” Expert Syst. Appl., vol. 69, pp. 214–224, Mar. 2017, doi: 10.1016/j.eswa.2016.10.043.

Ms. Madhuri Zambre. (2012). Performance Analysis of Positive Lift LUO Converter . International Journal of New Practices in Management and Engineering, 1(01), 09 - 14. Retrieved from http://ijnpme.org/index.php/IJNPME/article/view/3

D. Can, A. Kazemzadeh, F. Bar, H. Wang, and S. Narayanan, “A System for Real-time Twitter Sentiment Analysis of 2012 US Presidential Election Cycle Singing View project Emotion Prediction From Movies View project A System for Real-time Twitter Sentiment Analysis of 2012 U.S. Presidential Election Cycle.” Association for Computational Linguistics, pp. 8–14, 2012. [Online]. Available: https://www.researchgate.net/publication/262326668

L. Di Persio and O. Honchar, “Artificial neural networks approach to the forecast of stock market price movements.” [Online]. Available: http://iaras.org/iaras/journals/ijems

D. Shadrin, A. Menshchikov, A. Somov, G. Bornemann, J. Hauslage, and M. Fedorov, “Enabling Precision Agriculture through Embedded Sensing with Artificial Intelligence,” IEEE Trans. Instrum. Meas., vol. 69, no. 7, pp. 4103–4113, Jul. 2020, doi: 10.1109/TIM.2019.2947125.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Ajay Kumar, Varun Srivastava, Mahesh Kumar Chaubey, Megha Sehgal

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

All papers should be submitted electronically. All submitted manuscripts must be original work that is not under submission at another journal or under consideration for publication in another form, such as a monograph or chapter of a book. Authors of submitted papers are obligated not to submit their paper for publication elsewhere until an editorial decision is rendered on their submission. Further, authors of accepted papers are prohibited from publishing the results in other publications that appear before the paper is published in the Journal unless they receive approval for doing so from the Editor-In-Chief.

IJISAE open access articles are licensed under a Creative Commons Attribution-ShareAlike 4.0 International License. This license lets the audience to give appropriate credit, provide a link to the license, and indicate if changes were made and if they remix, transform, or build upon the material, they must distribute contributions under the same license as the original.